Homebuyers Win Refund After Builder Violates RERA Rules on Allotment and Sale Agreement

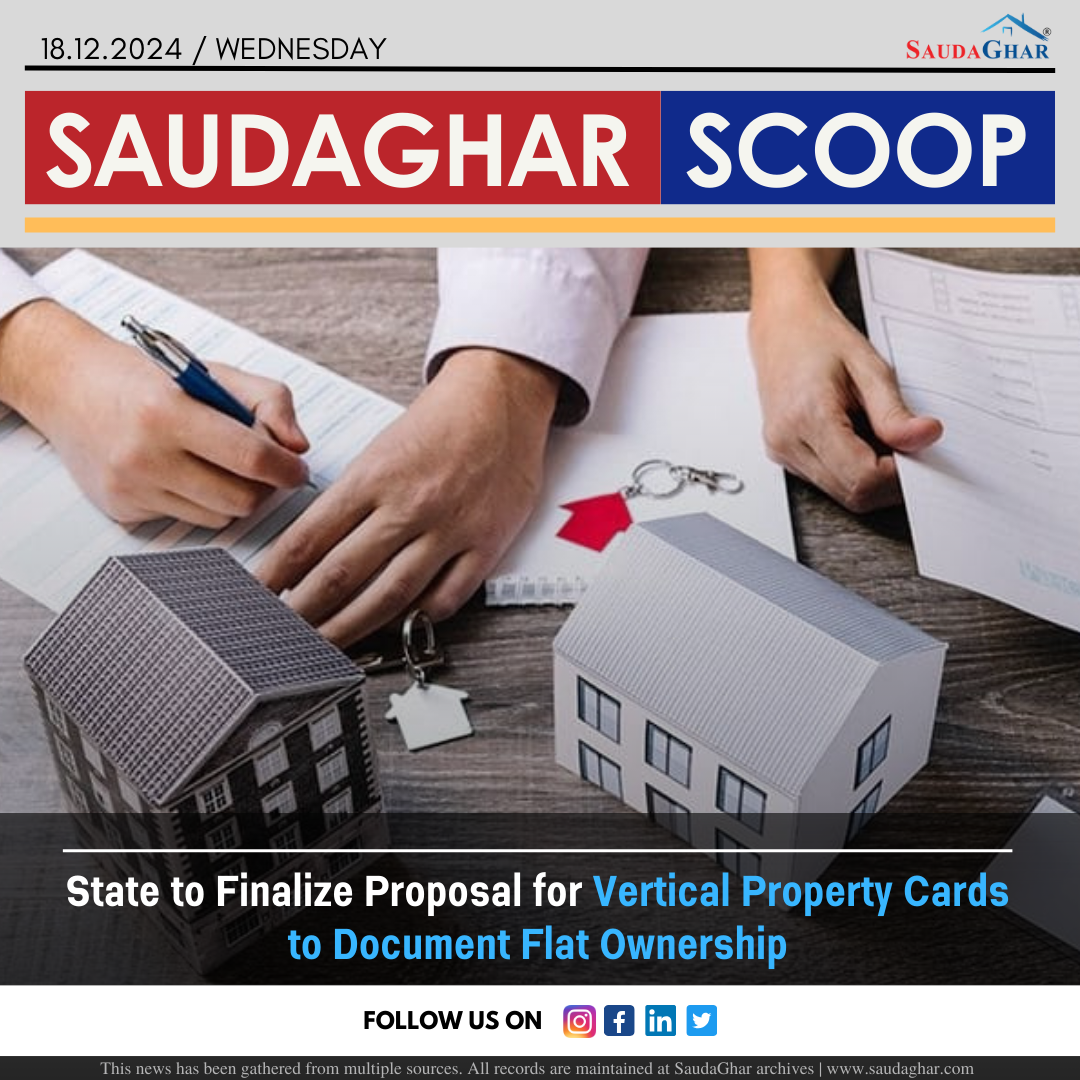

A Mumbai couple faced complications after booking a flat when their joint home loan application was denied by HDFC Bank due to the allotment letter being issued solely in the wife’s name. Despite repeated requests for a joint letter, the builder refused to issue one, prompting the couple to cancel their booking and seek a refund of the ₹13.5 lakh advance payment. Instead of refunding, the promoter demanded an additional ₹6.5 lakh and threatened a 2% interest charge if unpaid. Following the couple's complaint, MahaRERA directed the promoter to comply with Section 13 of the RERA Act, requiring a signed sale agreement before accepting more than 10% of the property cost. However, the builder remained uncooperative, leading the couple to escalate the case to the Maharashtra RERA Appellate Tribunal (MahaREAT).

MahaREAT ruled that the promoter had violated Sections 13 and 18 of the RERA Act, which restrict promoters from demanding payments exceeding 10% of the apartment’s cost without a registered sale agreement and allow buyers to seek refunds if promoters fail to fulfill legal obligations. The tribunal ordered the promoter to refund the couple’s advance payment with interest, totaling ₹20.65 lakh, due to the builder's non-compliance and unauthorized forfeiture attempts. This ruling emphasizes that forfeiture clauses must be reasonable, and promoters cannot withhold buyers’ money without proving actual damages from a cancellation.